These Tips Will Help You Reduce Debt Stress And Getting It Under Control

This article explains the top 7 strategies you can use to reduce the stress of your debts and getting your debts under control. As a bankruptcy law firm in Hartford, our primary goal it to get you completely out of debt, and at the same time provide tips that will make the process easier for you.

The Side Effects of Being Debt

Debt is considered one of the biggest life-events that causes stress. What this means is that those who know they have debts hanging over their head always have their debts as a reminder lingering in their day to day thoughts. Living with this daily reminder is not a healthy way to live, and can unnecessarily take your focus off the important things in your life. Being in debt can negatively affect your sleeping habits, cause marriage issues, hinder you from getting good credit and virtually put your whole life on stand-still while you’re continually living check-to-check and not being able to save your money.

Below is a summary of our top 7 debt stress reduction tips:

- Spend Money on What You Need

- Don’t Spend Money You Don’t Have

- Put Away a Few Bucks a Month for Savings

- Prioritize Your Debts

- Consider Getting Credit Counseling

- Ask For a Lower Interest Rate

- Consider Selling Things You Don’t Need

1. Spend Money on What You Need

One major way to get your debts under control is by purchasing only things that you need. When you’re in major debt it’s certainly not advisable to go on expensive vacations or buy a new car. This goes with the small things too. For instance if you don’t really need new socks or pants, don’t buy them. If you can wait until your debts are better controlled or even gone, then wait. You’ll be happy you made these small sacrifices instead of living in debt for years and years to come.

2. Don’t Spend Money You Don’t Have

This is a clear-cut suggestion to completely stay away from using credit cards while you’re in debt unless you are in dire-straits or an emergency situation. Credit cards have fees and interest costs and using them will only increase the amount of money you have to pay on your debts at the end of the month. The long story short is that when you’re in debt, and paying your debt off monthly, you don’t want to add more debt to your plate. In the end this form of sacrifice will pay off and reflect better on your credit report.

3. Put Away a Few Bucks a Month for Savings

If you’re following the advice in the two points above, you’ll actually find that you’re about to save a lot more money a month that you were able to in the past. After about 6 months of putting away a few bucks a month into your saving account, you’ll feel a whole lot better about your financial situation, and you’ll feel proud that you’re able to responsibly build up your savings account. Remember it doesn’t matter if you’re putting away 10 dollars or 50 dollars, as long you’re putting something away you’ll feel like you’re actually accomplishing something which will positively affect your bottom line. That feeling will substantially reduce the stress of your debts.

4. Prioritize Your Debts

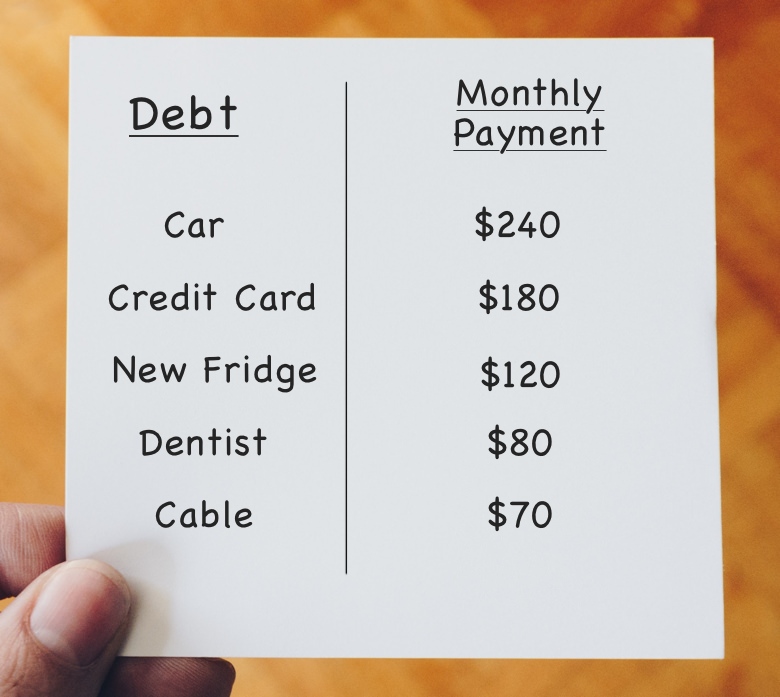

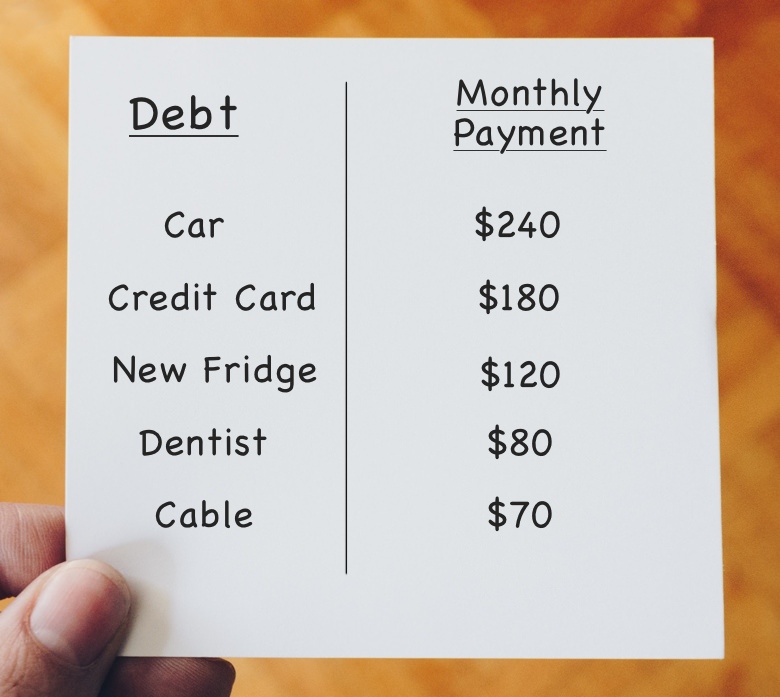

This debt reduction strategy is the easiest but it takes a little bit of organization. Get a pen and a piece of paper out. Write down all your debts from top to the bottom of the page, and most importantly in order of importance. Obviously a vehicle debt will be more important than a debt to your cable company, and a credit card debt could be more important than the debt to your dentist. In any case the first step is to prioritize your debts into a list and then create a second column.

This debt reduction strategy is the easiest but it takes a little bit of organization. Get a pen and a piece of paper out. Write down all your debts from top to the bottom of the page, and most importantly in order of importance. Obviously a vehicle debt will be more important than a debt to your cable company, and a credit card debt could be more important than the debt to your dentist. In any case the first step is to prioritize your debts into a list and then create a second column.

In the second column beside each debt item, list the amount you’re willing to or able to pay each month. At the end of each month (or which ever day you pay off your debts) start with the top-most debt and pay down your list.

Approaching paying your debts through prioritization enables you to get your important debts paid off as quickly as possible and leaves you with room to put off paying some less important debts during months that you don’t have enough income. Once the more important debts are completely paid, you’ll have money left over to pay the smaller debts, and even put some of your money into your savings account if you like.

5. Consider Getting Credit Counseling

One of the most effective ways of learning how to reduce the stresses associated with debt is through credit counseling. Credit counseling will provide you with all the tools you need to manage your income and expenses, and the strategies are presented to you in simple but highly effective terms. It can also be one of the best ways to help you avoid bankruptcy as long as you put the strategies to use.

6. Ask For a Lower Interest Rate

Now that you’ve prioritized your debts as explained above in point 4, you can actually take a swing at contacting your creditors and asking for a lower interest rate, or even ask them to reduce your debt. Contrary to popular belief, creditors are always mean people and if you explain to them that you’re eagerly trying to get out of debt and would like to pay off the debt you owe them as quickly as possible, they may accept your request at lowing your debt or interest rate if you promise to pay it off quicker. You can work with the creditor to find terms that work for both of you but your objective is to lower the debt or its interest and getting it paid off as quickly as possible.

7. Consider Selling Things You Don’t Need

Another great way of reducing your debts and/or saving extra cash to put down on your debts or put away is by selling off items in your home that you don’t need anymore. You may have some antique items that would sell for a pretty penny, or just a bunch of things in your basement or attic that you simple don’t use anymore. All you need to do is take an inventory of those items, take a picture and post it on a site like Kijiji which will enable you to find buyers completely free of charge.

You can start by selling only 10 items and after you’ve sold those things off and have reaped the benefits, you can start another sell off of other items you don’t need anymore. Remember that once you start getting paid don’t get too exited except for the fact that you’ll be able to put that money towards paying off a debt that’s been bother you.

Bonus: Consider Bankruptcy

There sometimes comes a time when a person’s debts are too much, and filing bankruptcy is the only way to get it under control. If you feel this is the position you’re in, there’s no better time than the present to consider bringing your case to a bankruptcy lawyer and figure out what your legal options are. Contrary to popular belief, declaring bankruptcy is not a negative, but instead it’s a useful tool available to those who wish to remove their massive debts legally.

The Take Home

The point of this article is two-fold. One is to show you that being in debt doesn’t have to always be stressful, and that getting your debts under control is actually not that difficult. As long as you approach your debts with a positive outlook and take some of the points laid out in this article into consideration, you’re bound to be on your way to financial freedom in a shorter period of time than if you had let your debts overwhelm you. The choice is yours.